Homeowners Insurance in and around Spring

A good neighbor helps you insure your home with State Farm.

Help cover your home

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

Everyone knows having fantastic home insurance is essential in case of a windstorm, tornado or blizzard. But homeowners insurance is about more than covering natural disaster damage. Another valuable component home insurance is its ability to protect you in certain legal situations. If someone gets hurt because of negligence on your part, you could be held responsible for the cost of their recovery or their medical bills. With good home coverage, your insurance may cover those costs.

A good neighbor helps you insure your home with State Farm.

Help cover your home

Safeguard Your Greatest Asset

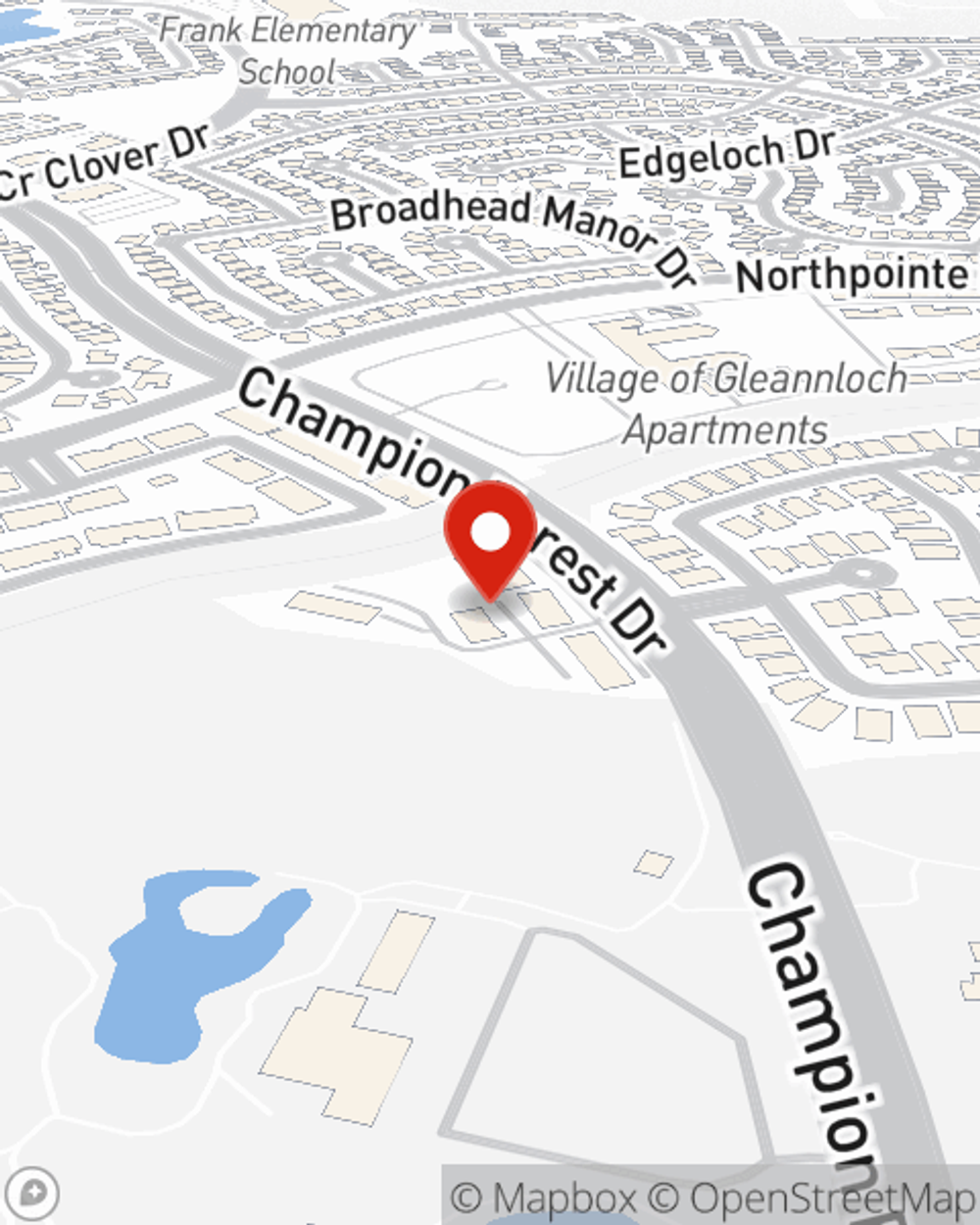

Protection for your home from State Farm is a great next step. Just ask your neighbors. And call or email agent John Davison for additional assistance with getting the policy information you need.

For exceptional protection for your home and your momentos, check out the coverage options with State Farm. And if you're ready to see how you can save on a home insurance policy, visit State Farm agent John Davison's office today.

Have More Questions About Homeowners Insurance?

Call John at (281) 826-0400 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Why cleaning your chimney is important

Why cleaning your chimney is important

Fireplaces provide warmth and ambiance in the winter, but build-up can occur in the flue and be hazardous. Learn how to keep a clean chimney.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

John Davison

State Farm® Insurance AgentSimple Insights®

Why cleaning your chimney is important

Why cleaning your chimney is important

Fireplaces provide warmth and ambiance in the winter, but build-up can occur in the flue and be hazardous. Learn how to keep a clean chimney.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.